Gm frens.

Lately I’ve found myself more and more involved in crypto.

Specifically NFTs.

Staying up late chatting in discords, researching projects, and re-evaluating my portfolio.

You might be thinking “why”?

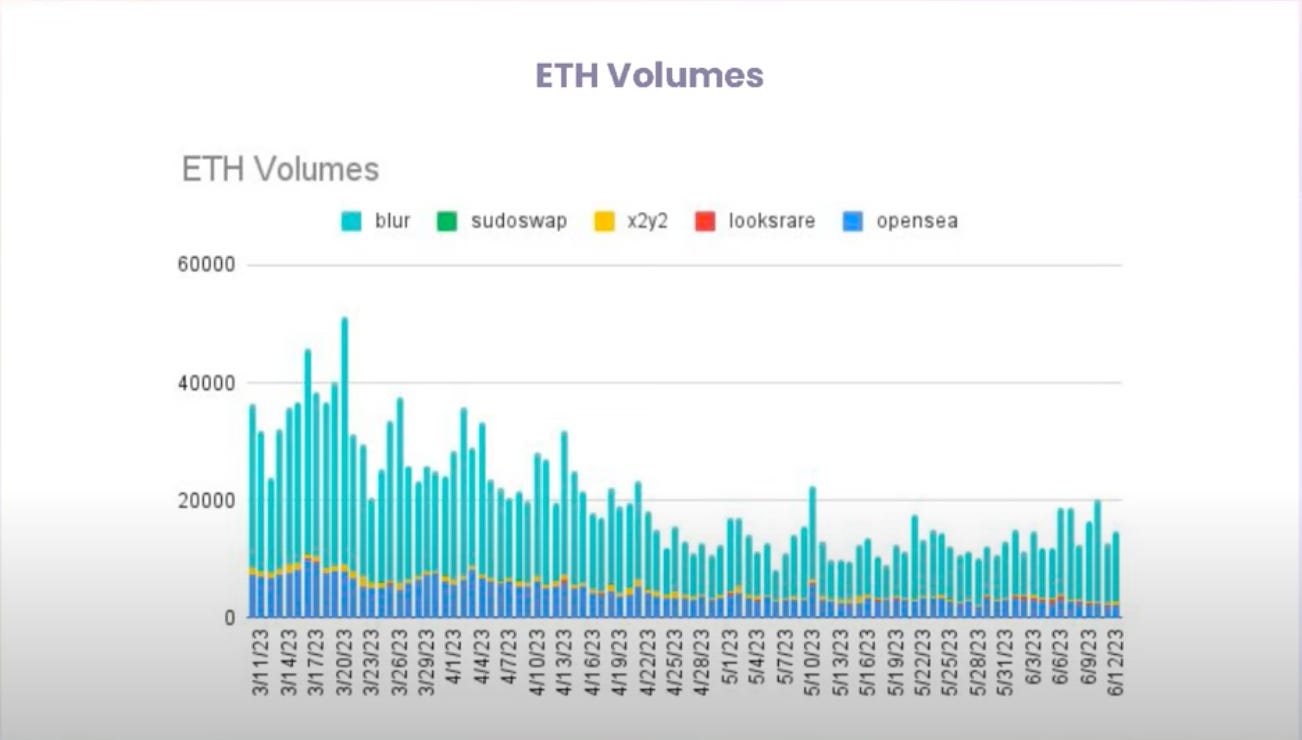

Especially when every week it seems that we’re setting new records for low volume, low volatility, low unique users/traders in the space, and increasing levels of dumps into bids.

Chalk it up to a feeling.

It “feels” to me like we’re hitting all time lows in terms of participation and interest in NFTs—which makes a lightbulb go off in my head that says “pay attention”.

Please understand that I am NOT saying that I think NFTs are going to rally anytime soon.

In-fact, I believe many NFTs will continue to bleed out over the coming weeks (and potentially months).

Look at this chart, it’s bad out there:

But it’s in these down times where opportunities present themselves and those with the conviction to buy *good projects* can capitalize on them.

So let’s take a little stroll down blur-street and see what we can find.

NFT “Blue Chips” As of June 2023

You have probably heard the term “blue chip” thrown around for a long time. But what is a “blue chip nft” exactly?

The term “blue chip” comes from our frens over in tradfi (traditional finance), referring to the biggest and bestest public companies in the world.

“A blue chip stock refers to the shares of an established, profitable, and well-recognized corporation. Blue chips are characterized by a large market capitalization…”

Applying that to our precious JPEGs, you can come up with the following frame of reference:

A Blue Chip NFT collection must:

Have a large market cap / high trading volume

Be well established (Around for ~1 year +)

Well recognized (Big brand)

As you can see, this isn’t an exact science. But we’re talking about NFTs here so it’s good enough.

Now our kind friend @Punk9059 has been gracious enough to create a “large cap index” of all the biggest projects in the space and keeps meticulous track of them.

While I don’t agree 100% on his list of Blue chips, it’s good enough to start.

Here’s the list:

Cool Cats set (cool cats + cool pets)

Moonbirds set (moonbirds + oddities)

Pudgy Penguins set (pudgy penguins + lil pudgies)

Otherside set (otherdeed + koda + vessels)

Azuki set (Azuki + Beanz)

Captains set (Potatoz + Captains)

DeGods set (DeGods + Yoots)

Doodles set (Doodles + doopilator)

CloneX set (CloneX + whole bunch)

Veefriends set (Series 1 + Series 2)

World of Women set (World of Women + Galaxies)

Punks set (Punks + Meebits)

BAYC set (BAYC + MAYC + BAKC)

Gutter Cats set (I have no idea tbh)

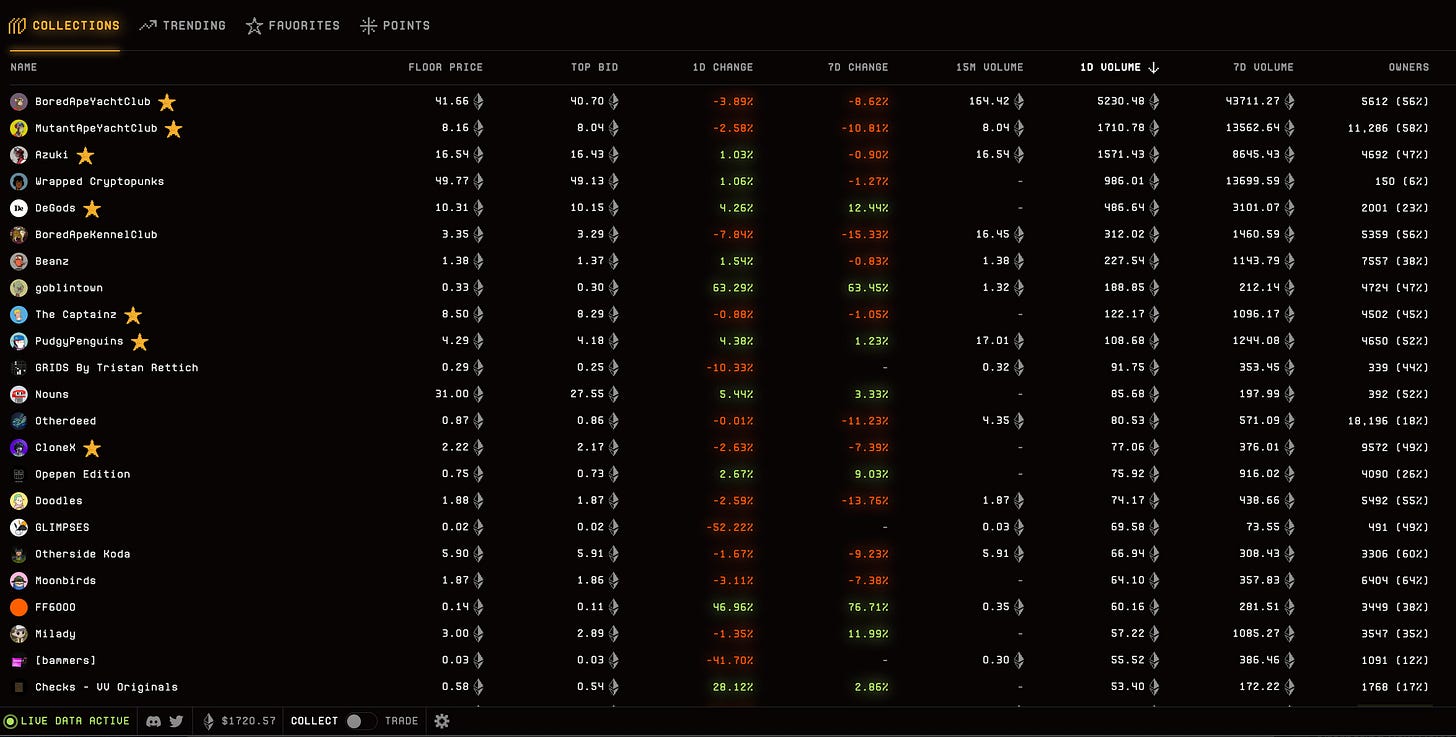

Here is the large cap PFP index below:

Something interesting to note is that he doesn’t include art projects in his list. It’s probably because he counts them as a completely separate category, whereas this is his “pfp” category.

Which is fine, we’ll keep going with this.

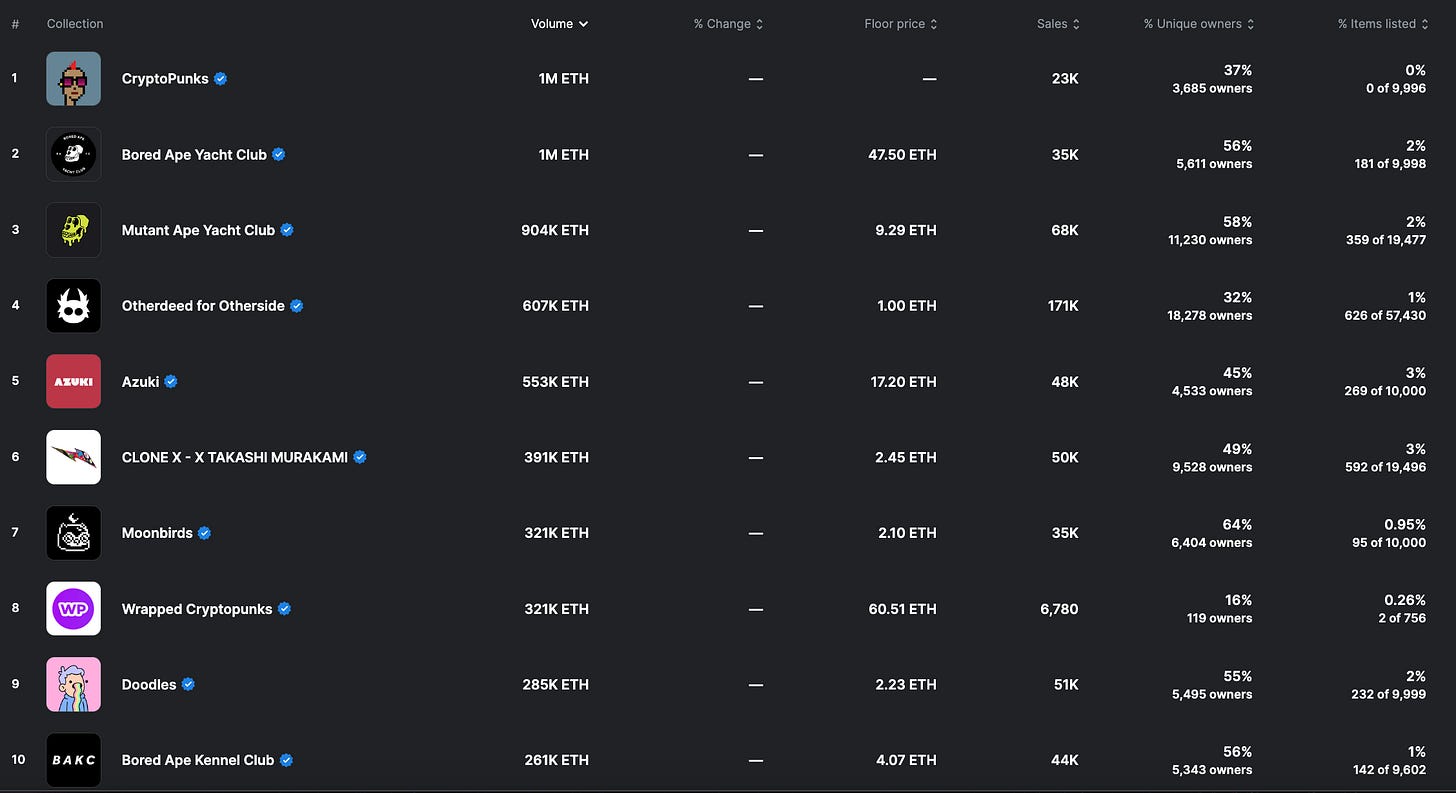

Looking at the all-time $$$ traded on these collections, they’ve definitely earned their stripes to be on this list:

Now that we have a good gauge of what a “Blue Chip NFT” is, we can get into the fun part…

Which projects have the most potential for the future?

Taking from the list above, I’m going to rank each “blue chip” project in a fun little tier list. Each project will be evaluated solely based on what I remember and given a letter grade from A to F.

This list is, of course, cannon.

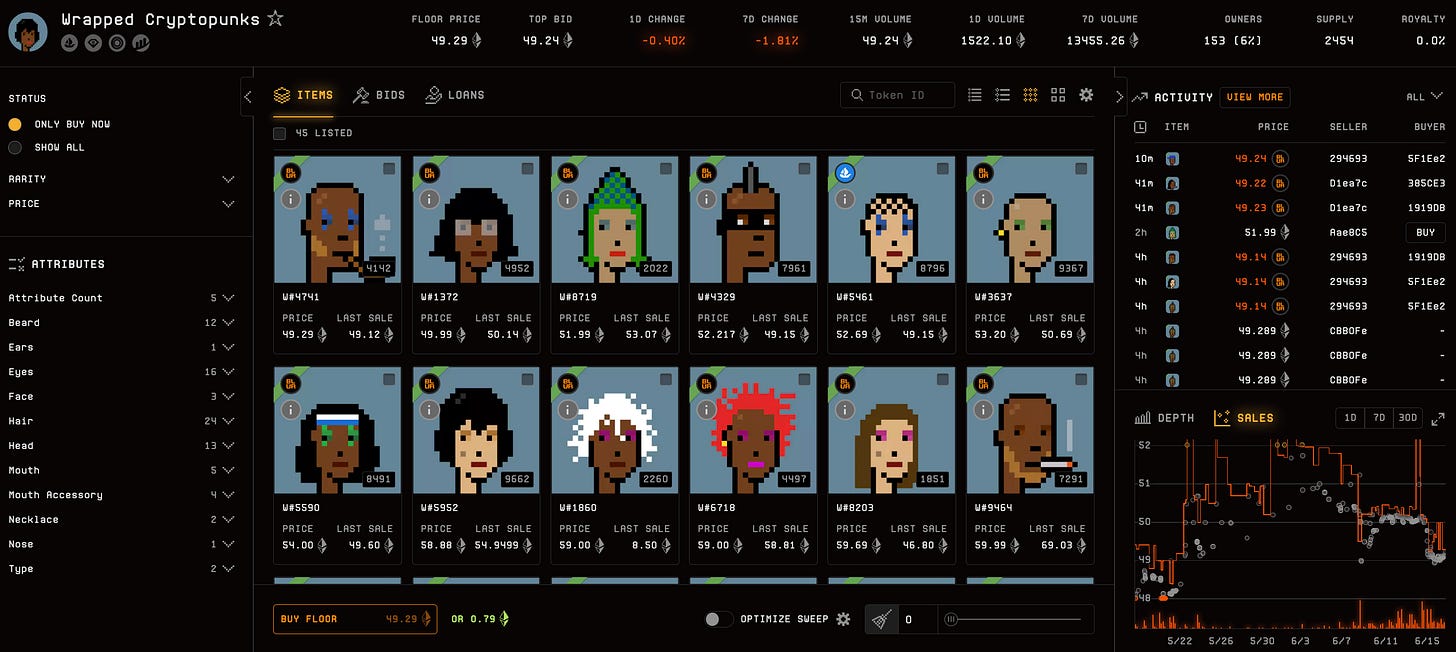

Punks set (Punks + Meebits) - A

The OG’s of NFTs. Crypto punks are the undisputed kings of NFTs and they will never go away simply because they are punks.

Their “utility” is their history, which grows longer and more enshrined with each passing day.

They have “lindy”, which is referring to the “Lindy Effect” where you can reasonably expect Punk’s brand to continue to last for at least 2x the amount of time they’ve been around for.

Since they were created in 2017, that was 6 years ago, so you can tack on another 6 years, pushing us to 2029, and so on and so forth.

They will always be a top collection because of their prominence in NFT & Ethereum history and you can quite literally never go wrong with owning a punk.

Meebits on the other hand… they also have a strong historical component and they also likely will never go away. But they do not have the same appeal as punks. Not much to say about them, they’re meebits.

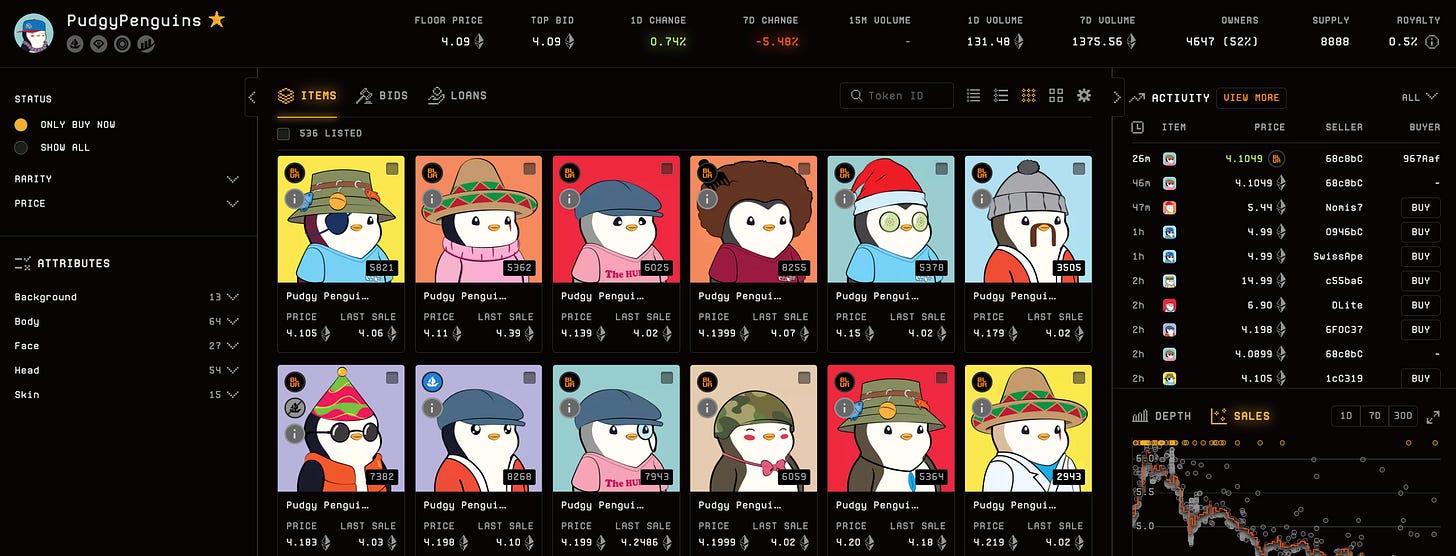

Pudgy Penguins set (pudgy penguins + lil pudgies) - A

Pudgy penguins have a BRIGHT future ahead of them.

I actually held a pudgy from the OG days (it was one of my first NFTs I ever bought in August 2021) but I exited the ecosystem after the original team abandoned and sold the project.

I did not think that we were going to see the incredible turn around that Lucas has done with the penguins, but I am glad to see it.

They have an incredible founder that “gets” crypto and also “gets” business. They are branching out in all the right ways, creating memeable videos on tik tok/instagram that have recently crossed over 4 billion views—greatly expanding the brand presence to people outside of crypto.

They created a cute toy line that is absolutely crushing it on Amazon. But they are not only just toys, they are toys with a “digital collectable” component, whereupon people scan a QR code on their toy and they can mint NFTs on polygon that they can use to accessorize their penguin. These accessories can then be traded to other collectors. This is an ingenious step that gets people involved in the NFT ecosystem without them actually knowing they’re in the NFT ecosystem.

I’ve also heard we have some interesting games/more tricks up their sleeves over the coming weeks/months. Pudgy Penguins (and lil pudgies as well) have a bright future and I’m excited to see what they come up with next.

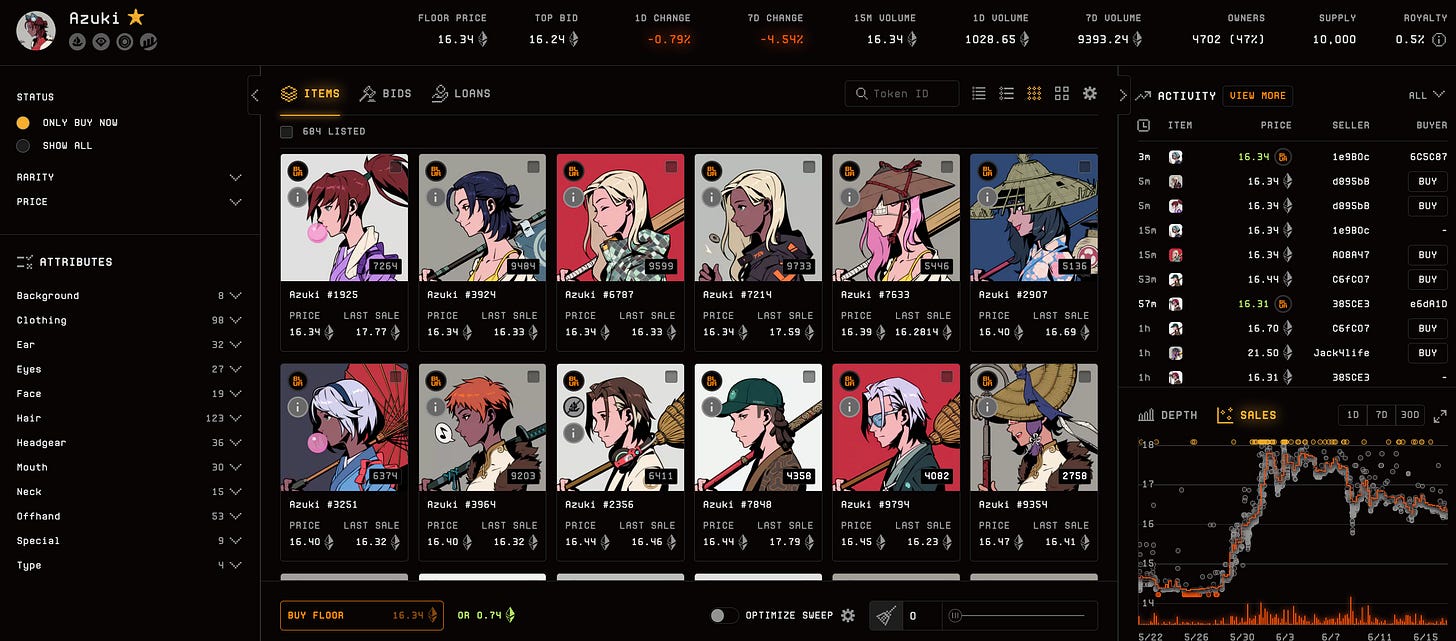

Azuki set (Azuki + Beanz) - A

Azuki’s are cool, they always have been. They burst upon the scene in early 2022, inventing a new type of minting experience (ERC-721c) that revolutionized the space, saving countless millions of $ in gas fees.

They have (in my and many others opinions) the cleanest and best art pfps in the space. More than great art, Azuki has always been about good vibes in the garden. They have one of the most ride or die & talented communities out there right now.

They quickly rose from 2 eth post mint to 30 eth at their peak in only a few short months, riding the last wave of the NFT bull market in 2022 before the market collapsed and they were hit with a massive FUD storm that threatened to derail the whole project.

I won’t get too into it, and I leave the interpretation up to you, fren, but here’s the TL;DR: The founder of Azuki, Zagabond, had a handful of NFT projects that he launched before Azuki. All of them failed. So, people were calling him a serial rugger, and they were proclaiming that if Azuki hadn’t taken off like it did, he would have dropped the project and moved onto another one.

Personally, I come from the tech startup world, and founders having multiple projects/companies under their belt is something that is encouraged for learning and growth. Seeing as the crypto world is the tech world on steroids, this doesn’t surprise me.

What I’m more concerned about is 1) did he intentionally hard rug the projects or 2) did he try to create something, it didn’t catch on, and he moved on? From what I could tell, he tried creating projects/brands and they didn’t catch on so he moved on. I never saw any evidence of malicious intent, so I lean more in the category of he’s an entrepreneur. To each their own.

Anywho… that FUD storm took them from 30 eth to 8 eth and they’ve spent the last year slowly rebuilding their community, pumping massive $$$ into the Azuki ecosystem and re-establishing themselves as a brand that is here to stay.

I don’t know what Azuki has up their sleeves, but with their massive Las Vegas event happening later this week, I am very excited to find out.

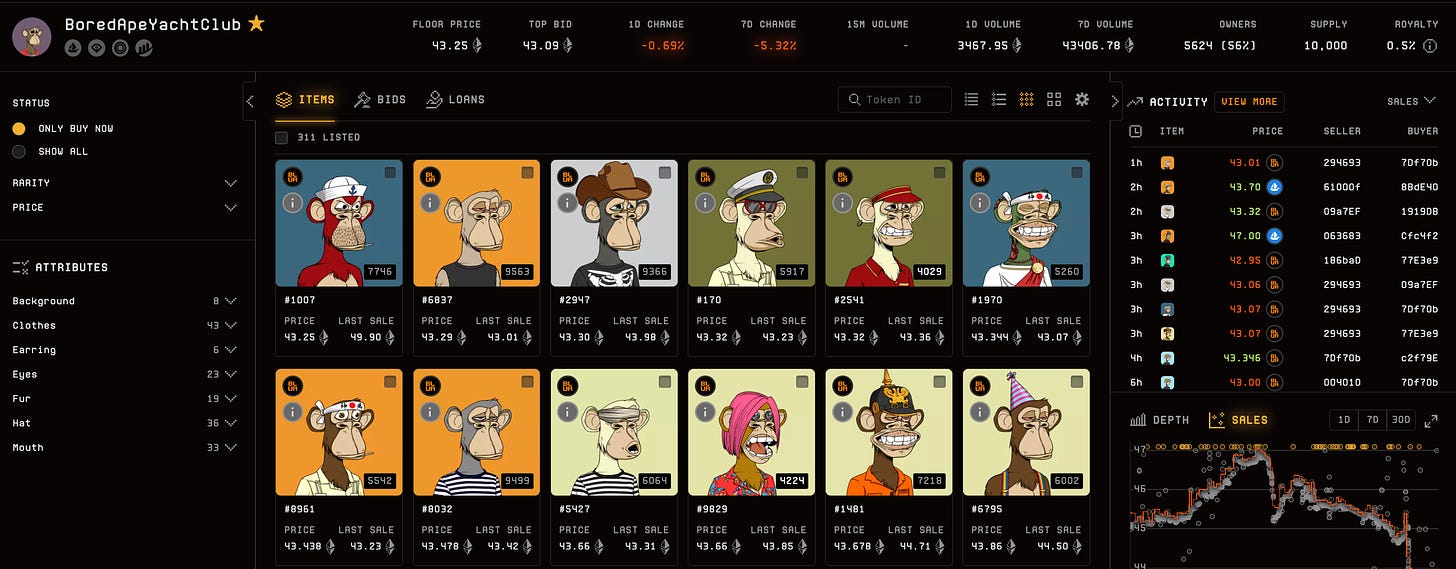

BAYC set (BAYC + MAYC + BAKC) - B

Bored Ape Yacht Club is the collection that made NFTs go mainstream. They BROKE into popular culture minting millionaires and capturing the attention of A-list celebrities.

They invented/revolutionized the entire industry with many, many, NFT projects simply following them and copying everything that they did.

I think many people either forgot or weren’t here to witness what happened during the Mutant Ape Yacht Club launch. Yuga created radioactive vials that were airdropped to all BAYC holders. Those holders then “drank” the vial and depending on the rarity of the vial “transformed” their BAYC into a MAYC either (level 1, level 2, or 10 1/1 lvl 3’s). The other 10k MAYC were auctioned off.

This was completely revolutionary for the space and SO MANY projects copied them after this. Why wouldn’t they? It was genius.

Then we had APE-coin drop to all BAYC/MAYC. We had Otherdeeds. We had Sewer Passes & HV-MTLS. Oh and don’t forget about BAKC!

Fact of the matter is, if you managed to get a BAYC at mint for 0.08 $ETH and held for the past 2 years, you were rewarded with $100’s of thousands of dollars/eth of free money falling into your lap.

BAYC is the ultimate success story of 2021 and in the past 2 years has completely changed so many peoples lives for the better. It is undeniable that these monkey pictures lead a revolution that changed crypto forever.

But are their best days behind them?

I’ve seen takes on both sides and I’m more of the camp that the only thing propping up the price of BAYC right now are blur farmers.

I don’t think BAYC will ever “die” but I can see them dropping another 40-50% from where they are today.

This is primarily because BAYC & Yuga have grown so big, and they’re doing so many things, that I’m not sure what’s next.

They’re putting a huge amount of time, energy, effort and money into into Otherside + legends of Mara, their upcoming video games—both of which are their own projects and are unaffected and unattached to the BAYC set.

So where does that leave BAYC/MAYC and what do they have to look forward to? I’m not sure.

However to count them out of the race entirely is a serious mistake in my opinion. As if there is any company that is capable of making lightning strike multiple times, it’s Yuga Labs.

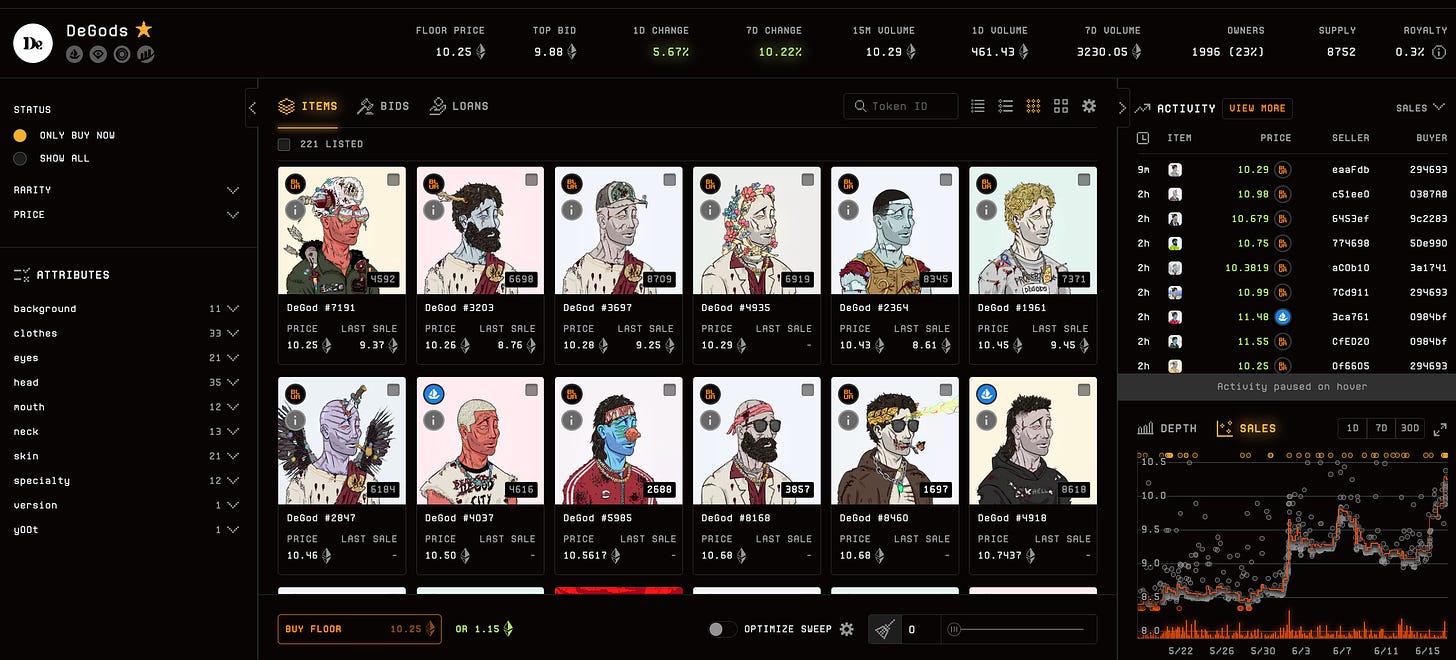

DeGods set (DeGods + Yoots) - B

You may love them, you may hate them, but you simply can’t ignore them.

Masters of hype, DeGods rose from nothing to the top collection on Solana, before jettisoning themselves off of Solana and migrating to Ethereum.

This was the first (only?) project to have successfully completely migrated chains. Oh, and they moved their second collection, Yoots, to Polygon at the same time.

Oh, and they also established themselves on BTC as an ordinal collection as well.

Over the past year I’ve been continually impressed with DeGod’s constant innovation and how they’ve embraced both the technology and spirit of Web3. Their founder and CEO, Frank, is energetic, enthusiastic, and the right type of crazy that you love to see in startup founders. The dude has “it”, that intangible & untamable fire inside of him that you see inside many of the great tech founders that create the massive companies of tomorrow.

My only caution is sometimes a fire that burns too bright can burn itself out. They are doing a lot and are fully embracing the “move fast and break things” ethos, I just don’t want to see them spread themselves too thin or try too many things and spin out of control.

With that being said, I don’t know what they’ve got up their sleeves next, I keep seeing De III and the hype continuing to climb, whatever it is, I’m just as excited as the next guy to find out.

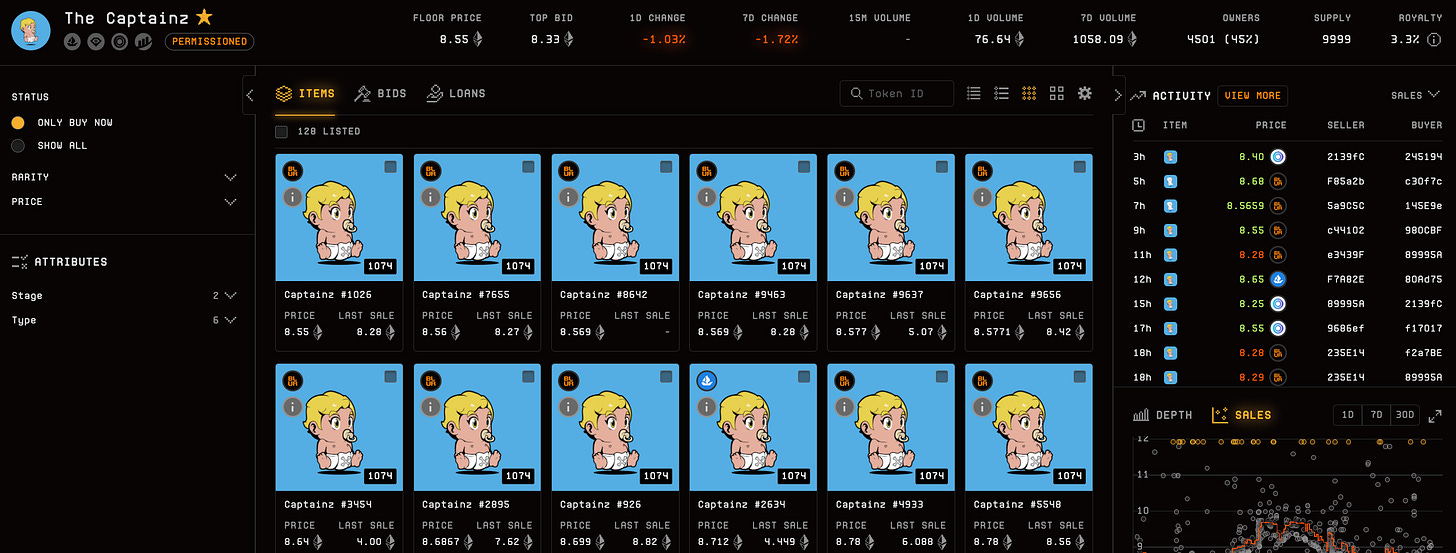

Captains set (Potatoz + Captains) - B

Memeland seems to do everything right.

At least they know exactly how to reward long-term holders/believers in their project and keep the hype cycle alive for months at a time.

The amount of thought and planning that has gone into their ecosystem is impressive. Captains launched at a 4-ish eth floor and have only continued to grind higher as time as gone on. (Despite still having placeholder art!)

Potatoz has been out for over a year and are still clinging to the top of the charts. With 9gag behind them, they clearly have a lot of firepower and they’ve gotten meme marketing down to a science.

So, why the B?

Well, with the much-anticipated release of their meme-coin just over the horizon their luster is starting to dull.

Launching a coin for your ecosystem is rife with dangers that can quickly sink your ship. Not to mention, they’ve been “building” a ton for their ecosystem, with a lot of exciting things planned for the future, but we have yet to see any of them materialize.

After whitelists for meme-coin were dished out this week, we’ve seen prices of captains and potatoz both falling. Is this a momentary retrace or signaling that the top is in?

Only time will tell.

Otherside set (otherdeed + koda + vessels) - C

Otherdeeds are in a tough position.

They quite literally broke ethereum for a day when they launched and they set out on one of the most ambitious goals in all of web3…

Create a massively popular and great online video game.

They have over 100k assets, which makes increasing the floor price a Herculean task. I don’t think we will ever see the prices that we saw post mint mania (8-12 eth) but I can’t count them out either.

Attending their latest “trip” tech demo was extremely impressive. We had like 8k-10k concurrent users with zero lag, pushing great graphics, playable on google chrome! For those that are not aware, that is an insanely technical feat.

But will it be enough?

The massively multiplayer online video games market is a TOUGH nut to crack. These are games that cost 100’s of millions of dollars and 4+ years to actually create and even after doing all of that, there is no guarantee they will succeed.

The problem here is that anything short of a massive success for Otherside will be seen as a massive failure, so they’ve really painted themselves into quite the corner here.

Ultimately, their goal is insane and that’s why I gave it a lower score. However, if there is any web3 project/company that might be able to turn insanity into reality, it’s Yuga Labs.

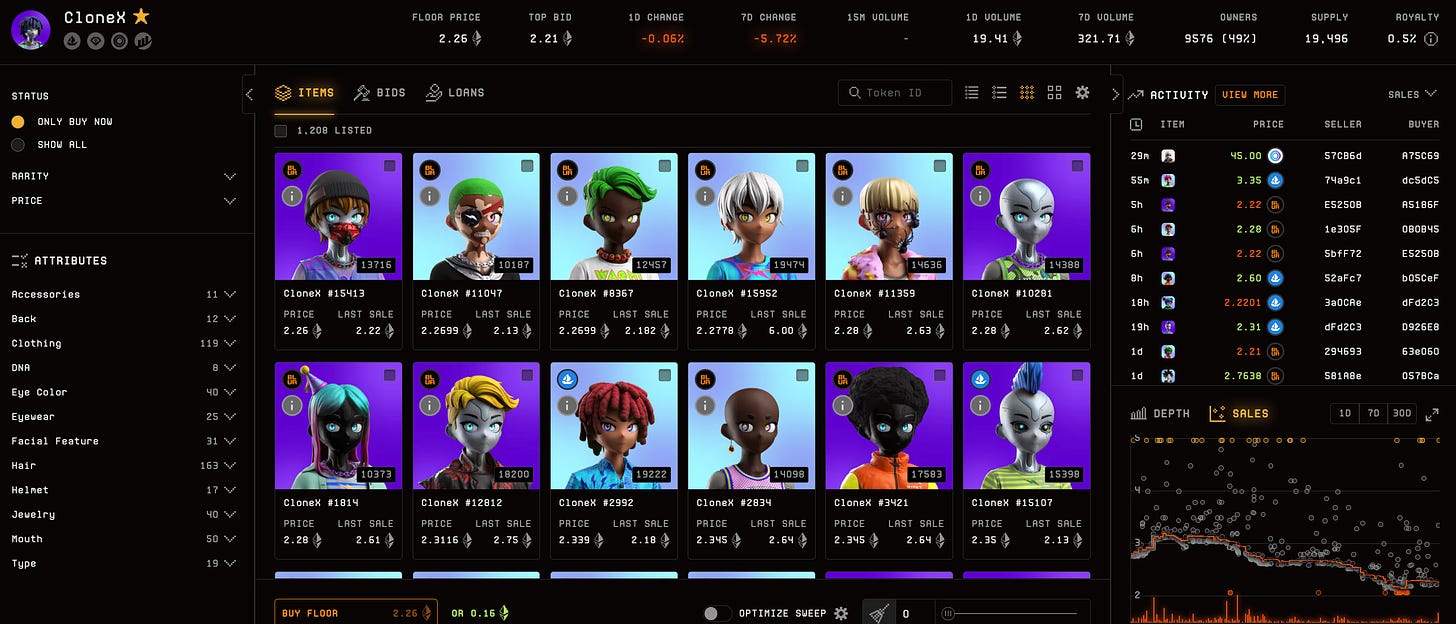

CloneX set (CloneX + whole bunch) - C

RTFKT is a great company.

They are innovators that single handedly pushed forward the digital/physical sneaker & fashion landscape; ex) minting an NFT that you can burn for a pair of physical sneakers.

They had a blockbuster sale to Nike at the peak of the bull market (Dec 2021) to continue building their operations and get some much needed distribution partners/financial security.

The amount of giving-back they have done for holders with various additional collections and drops might be the most of any NFT company. (As far as the amount of collections/gear airdropped to holders over their lifetime.)

Unfortunately some have said that so many drops has lead to collection fatigue. Also there were many people unsatisfied with physical drops they had waited months for, which I think was resolved.

I also don’t know what’s going on between RTFKT and dot swoosh. It seems like Nike threw it’s hat in the ring when they acquired RTFKT right? Like they would be the ones spearheading Nike’s foray into Web3? But it seems to me like nike is super focused on dot swoosh right now, so what does that mean for CloneX & RTKFT?

Regardless, I wouldn’t count out CloneX.

There is the project animus coming on the horizon and lord knows they’re well funded with Nike. It’s on the back burner for now but could be poised for a breakout moving forward.

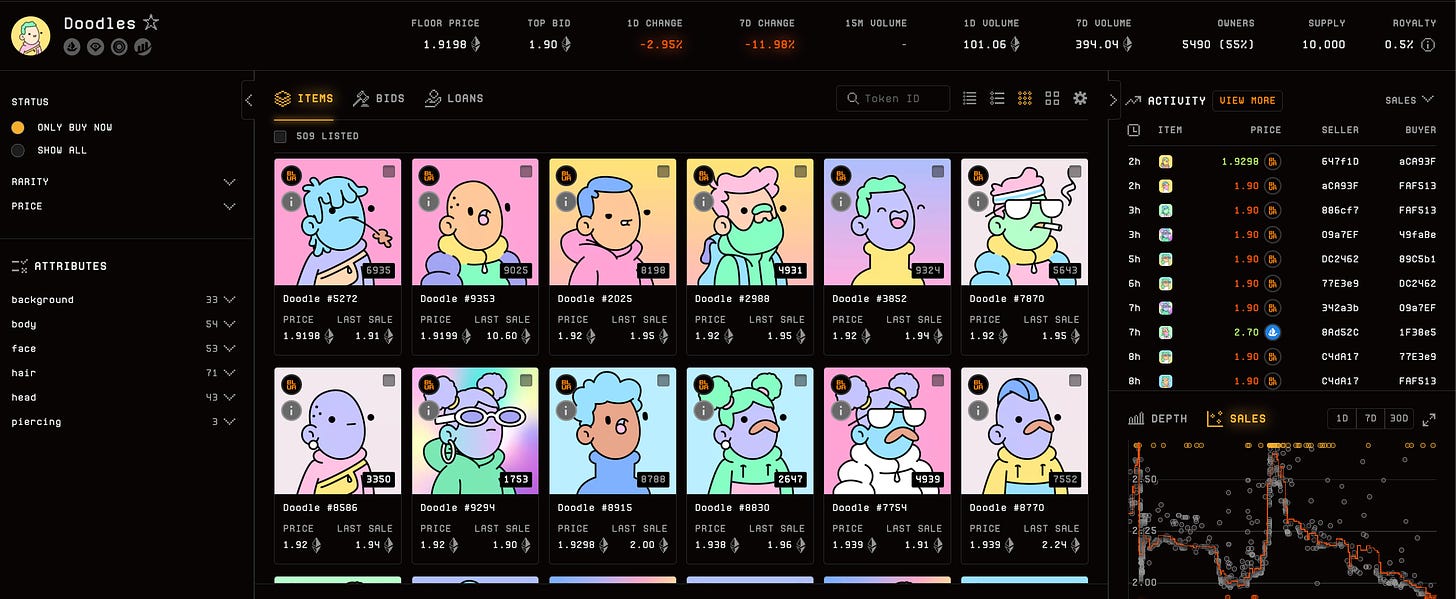

Doodles set (Doodles + doopilator) - D

A legendary artist, incredible art and a fantastic community, how could things have gone so wrong?

I think the answer lies in the fact that the people who poured blood, sweat, tears, and $$$ into building doodles into the juggernaut it became felt abandoned by the very team they helped rise to such great heights.

There’s the infamous discord incident where the founder responded to criticism about the project with “floor it and gtfo”. Then, proceeded to double down on that stance and further alienate some of their most staunch supporters.

For such a long lag-time between doing anything of note, the response to the criticism was sad to see. With that being said, there are some bright spots.

There’s doodle2 which, while a very ambitious project that took way longer to bring to fruition then was expected, it does seem pretty cool so far.

At least, the beta does. There’s tons of partnerships and big bag of VC funding they acquired to push forward.

I’m all for trying new things and expanding the NFT empire into normies, but there’s a right way of going about it and a wrong way of going about it.

Penguins are doing it the right way, Doodles really got off on the wrong foot here. Perhaps the success went to their heads.

It does have potential, however, turning your back on your day 1 supporters leaves a gnarly wound. I wonder if the self-inflicted wounds will be too much to ever restore it to its former glory?

Moonbirds set (moonbirds + oddities) - D

I think Moonbirds best days are behind them.

Kevin Rose is a great tech founder but unfortunately has not executed well with Moonbirds.

I feel like this collection was given the world right from the get-go and has continually shot itself in the foot to bring it down to where it is today.

We had the cc0 disaster. We had failed launches. We had insulting merch for people who spent small fortunes. We were promised a great conference that was shuttered. So on and so forth.

Then we had an abrupt pivot to be centered on art. Moonbirds just seems confused and continually lets holders down.

With that being said, perhaps, the transition to being focused on an art collective above all else carves them into the art niche and allows them to survive and thrive long term in the ecosystem?

They are also launching their 3rd collection, Mythics next month, so perhaps that gives them some juice to turn things around? I don’t know man, but I must say I am disappointed with how Moonbirds turned out over the past year.

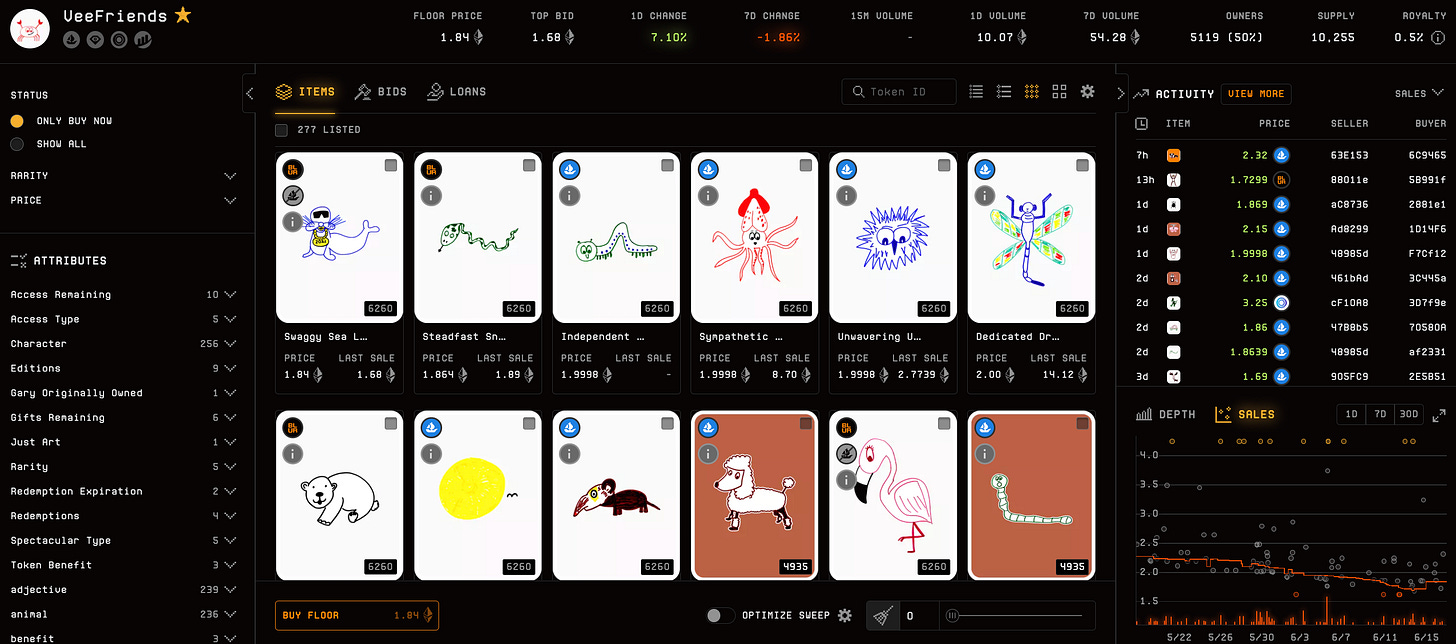

Veefriends set (Series 1 + Series 2) - D

I have a special place in my heart for VeeFriends.

It was actually the 1st NFT collection that I ever minted and was what got me started on my NFT journey.

Gary Vee is a titan and this is a “passion project” for him, so I don’t see Veefriends ever going away.

Also, something I always did respect and like about VeeFriends was that their value was always defined. 1 veefriend = 1 ticket to VeeCon, which having been to it, is the best NFT conference, period.

But now onto the bad…

People feel collection fatigue here, you’ve got 10.5k S1; 55k S2; 100k+ book games. Gary’s massive audience did lead itself to a good group of holders to buy, but on secondary? Not so much.

They did create unique value via burning excess nfts with both book games & their eruption project. But besides the legit value prop of the S1s, the other collections seem to pale in comparison.

There’s also lots of accusations that Gary has moved onto the shiny new object, AI, leaving his NFT collection in the dust.

Ultimately, I don’t really see anything exciting or innovative moving forward from here with Veefriends atm. The one bright spot is that Gary is always focused on the long-term so while other projects may run out of $$$ and be forced to shut down, the slow grind of VeeFriends might put it back in the spotlight come next cycle.

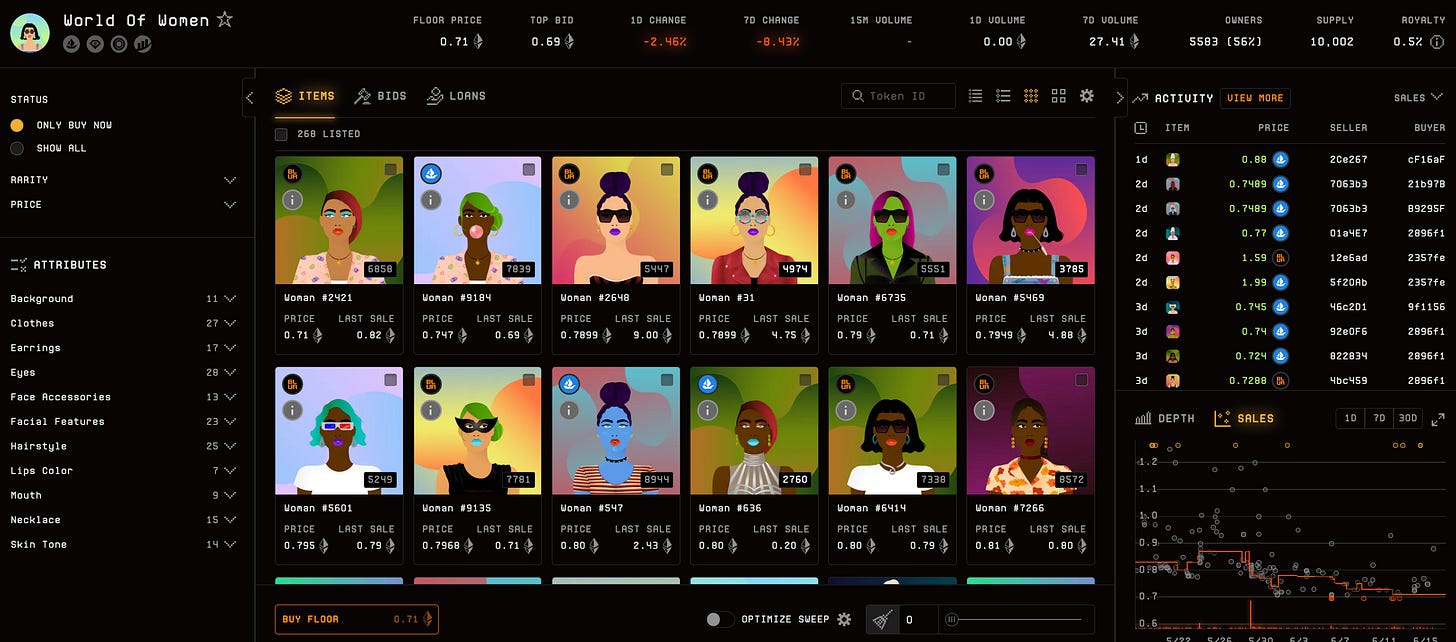

World of Women set (World of Women + Galaxies) - D

World of women works really hard and puts in a lot of effort. They’re really good at marketing and they put boots on the ground. They’ve been at basically every NFT event I’ve ever been to, and they do put a lot of time & resources in cultivating their community.

However, honestly, I can’t say that I paid too much attention to them.

I’m all for female empowerment but once woke lines get crossed it’s just too much.

Their galaxies collection mint was a bit rocky and definitely under preformed.

There was fud back in the day about the founder(s), i think it was something around portraying a collection by women, for women, but it really was just marketing because it was run by men. Again, I don’t know the specifics here and it’s quite possible that all of this was resolved but regardless, I’m not too interested either way.

They get an E for effort but as far as blue chips I’d want to hold, it doesn’t rank high on the list.

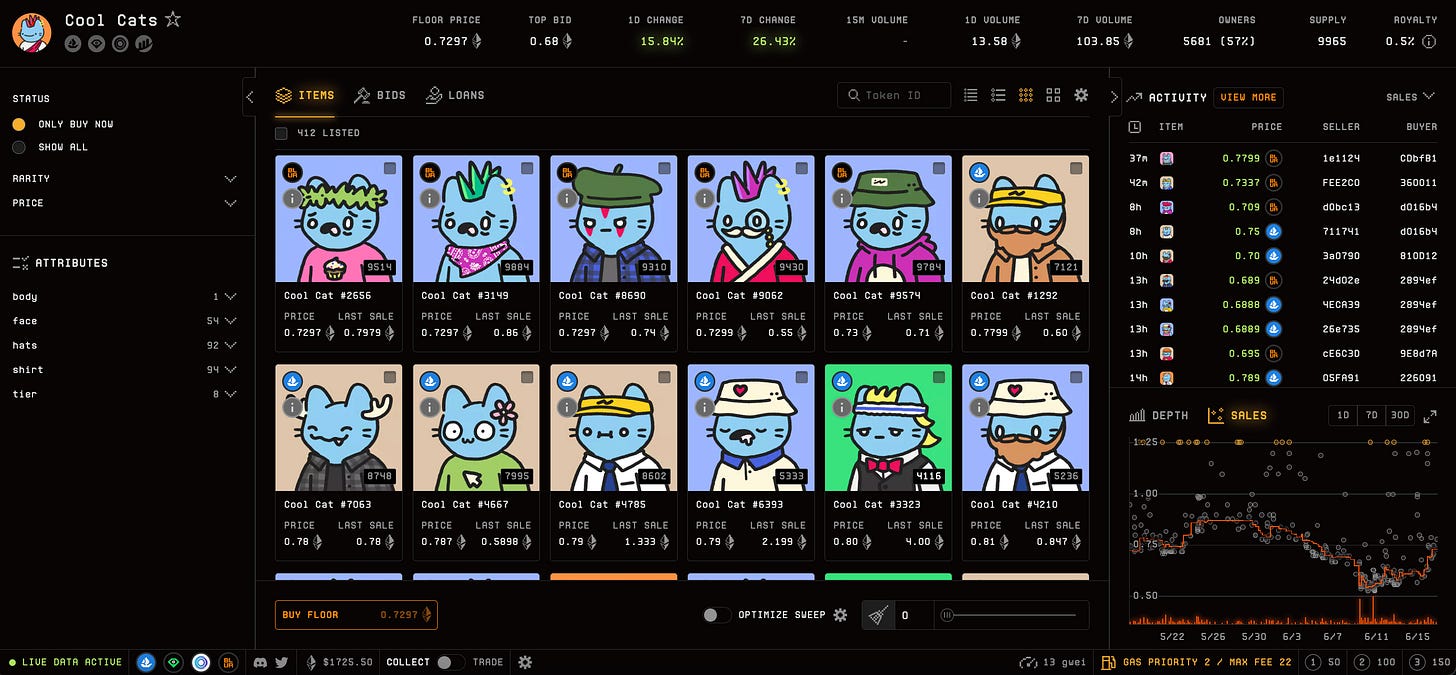

Cool Cats set (cool cats + cool pets) - F

This is a no from me dog.

Cool cats had its time to shine and unfortunately it spilled cold $milk all over itself (kek).

Cooltopia was overly ambitious, overly promised, and way under-delivered. The milk token was also a disaster.

Unfortunately those things became a black scars on the project that it was never able to recover from.

I do give them props for their installation at NFT NYC 2022, it was masterfully done.

But unfortunately cool cats lost all of its momentum, and I don’t see it ever coming back from that.

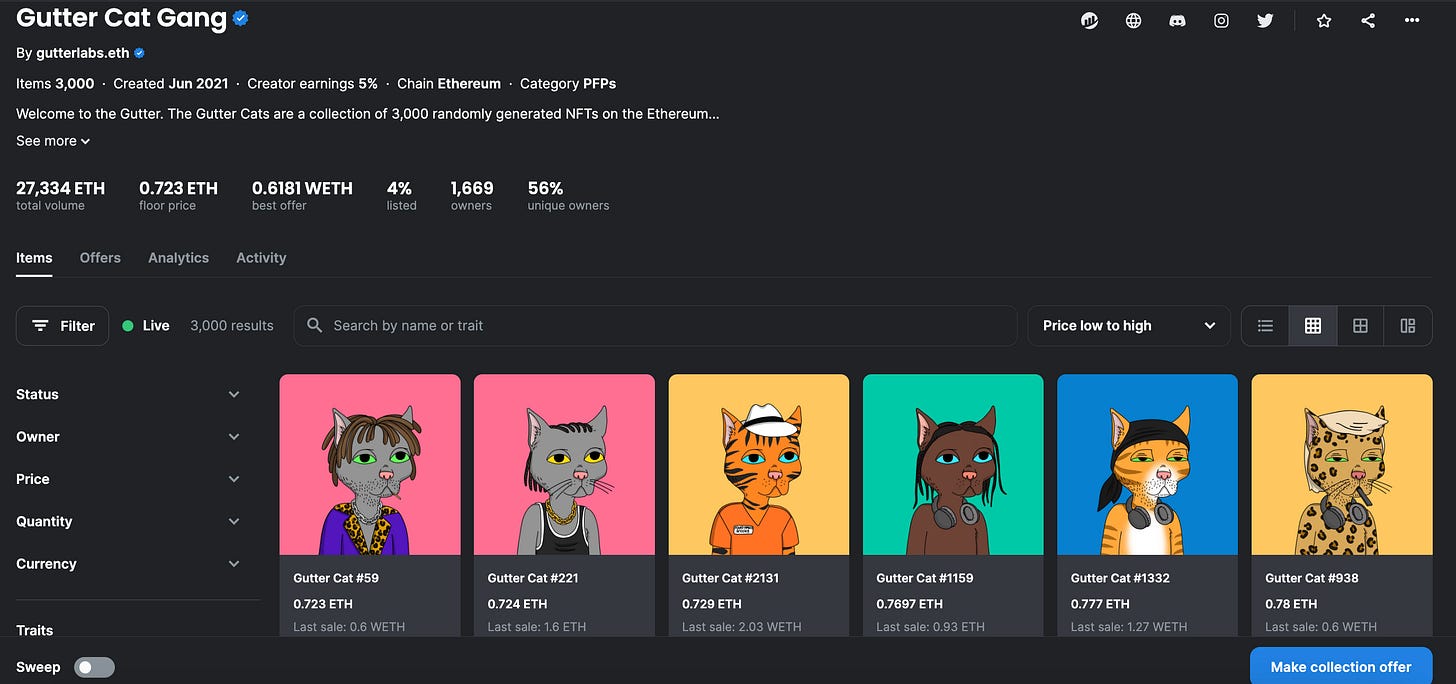

Gutter Cats set (I have no idea tbh) - F

I have no idea what’s going on with these guys. Nor do i pay them any mind.

I don’t even know why they are on the blue chip list as they don’t check off the box for recognition or high volume.

Automatic F.

The Ultimate NFT PFP BLUE CHIP TIER LIST (June 2023)

Some of you may agree with this list.

Some of you might think I’m (redacted) for the position of (your bags).

Say what you want, this tier list is cannon now and there’s nothing you can do about it.

All I can say for certain is that if you’re plugged in enough to be paying attention to me writing this and have strong opinions on any or all of these NFT collections, then you my friend might be mentally unstable but you’re doing it right.

We are in the midst of the NFT bear market and it’s the people who are paying attention now, building their stacks, and waiting for the right opportunity to strike that will end up winning bigly.

Keep moving forward, anon.

Until next time.

Your fren,

Golem